boulder co sales tax efile

The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans. The minimum combined 2022 sales tax rate for Boulder County Colorado is.

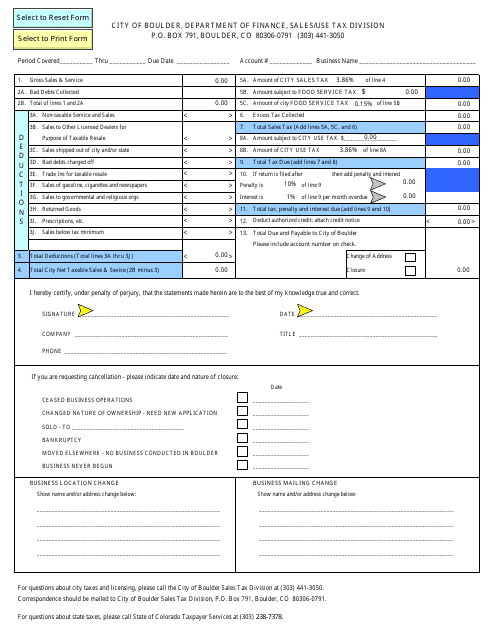

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

The Boulder County sales tax rate is.

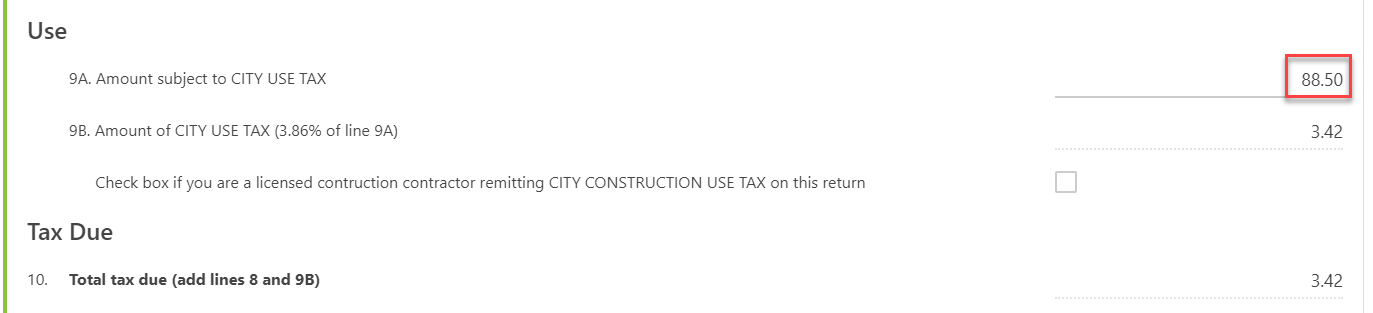

. Use tax is intended to protect local businesses against unfair competition from out-of-city or state vendors who are not required to collect City of Boulder sales tax. Yes any person that owns construction equipment with a purchase price of 2500 or more and brings it into the City of Boulder for use or storage is required to file a Construction Equipment Declaration to determine the use tax that may be owed to the City. 350 Homemade trailer ID.

DR 0154 - Sales Tax Return for Occasional Sales. Sent direct messages to Sales Tax Staff. Sales tax returns must be filed monthly.

Credit cards 25 minimum 395. Businesses with a sales tax liability between 15-300 per month. There is no provision for any po rtion to be retained as a vendor fee.

10 rows Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax. View amount of tax calculated by purchase amounts from 001 through 100 and search local sales tax rates by a specific address. Refer to Boulder Revised Code BRC 1981 section 3-2-2 a 9- 14 and Tax Regulations.

417 Year Tab Replacement. The 2018 United States Supreme Court decision in South Dakota v. Boulder co sales tax efile Saturday May 7 2022 Edit.

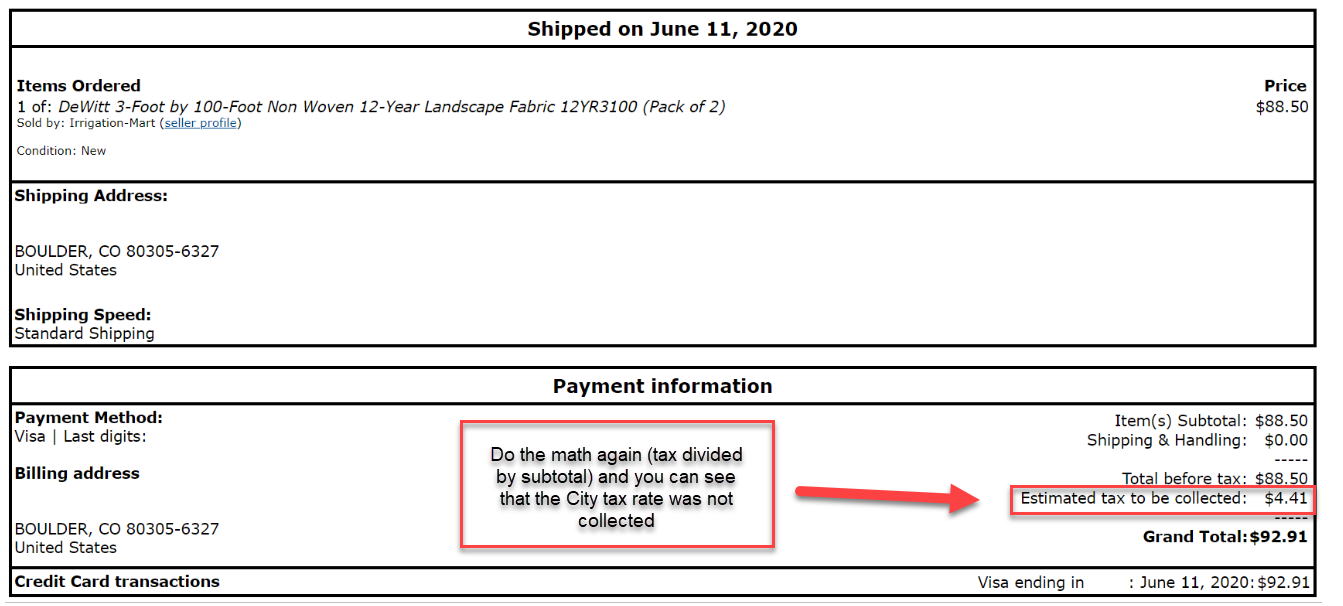

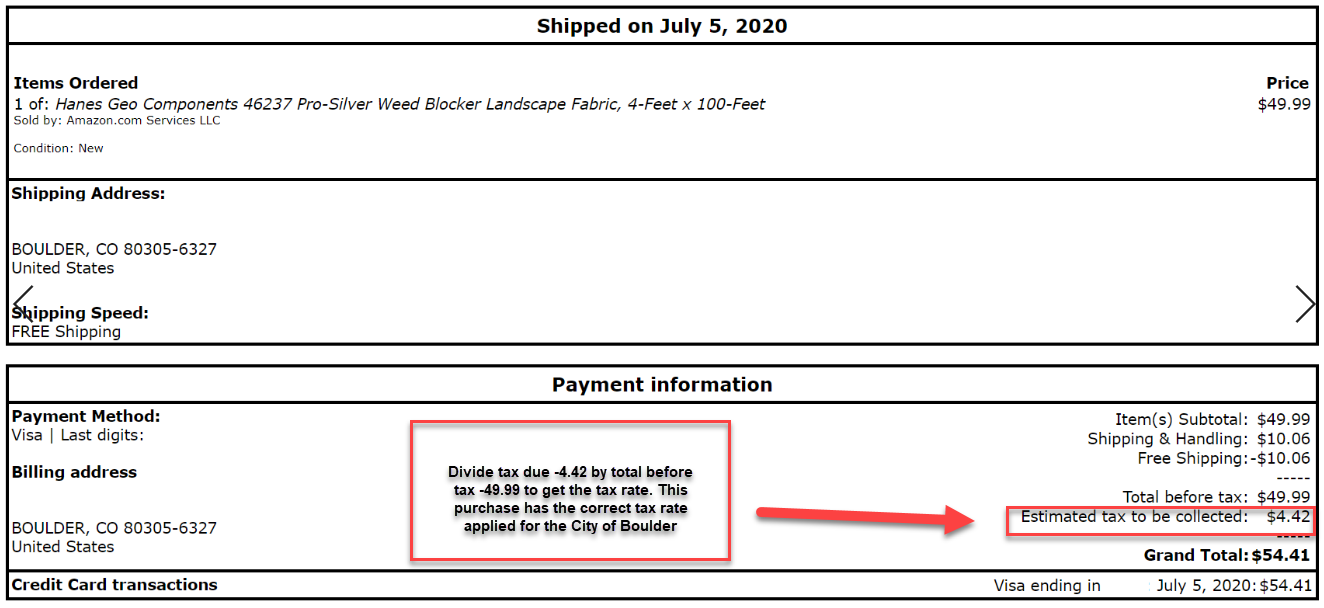

With proof of payment sales tax paid to another tax jurisdiction may be credited against consumer use tax due for a particular item. The Colorado state sales tax rate is currently. For tax rates in other cities see Colorado sales taxes by city and county.

Excess Tax Collected 000 7. The Colorado sales tax rate is currently. Businesses that pay more than 75000 per year in state sales tax.

720 Title print only. DR 0594 - Renewal Application for Sales Tax License. This is the total of state and county sales tax rates.

Kailee Nicole Foerster 2338 14th Street Unit 2 Boulder CO 80304 949-409-5911. This ordinance was developed by home rule municipal tax professionals in conjunction with the business community and the Colorado Department of Revenue as part of a sales tax simplification effort. This tax must be collected in addition to any applicable city and state taxes.

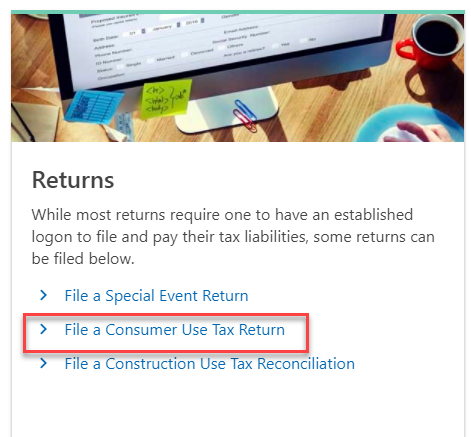

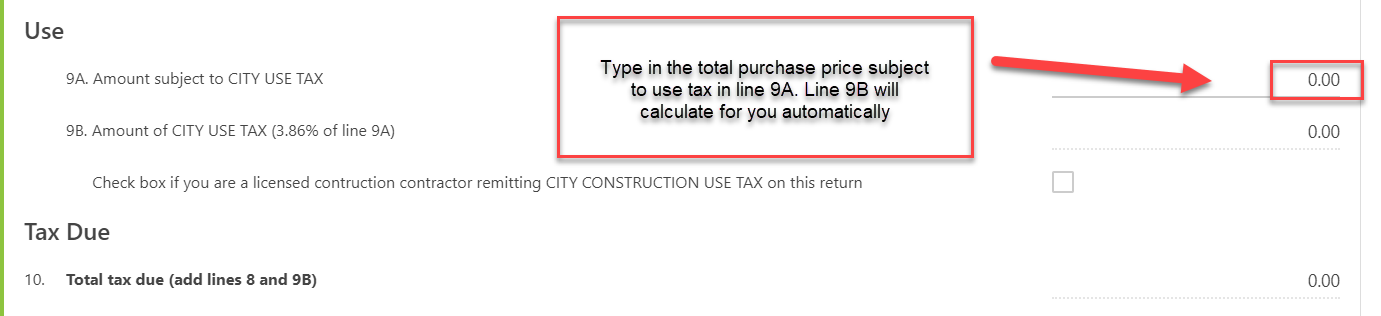

The city use tax rate is the same as the sales tax rate. Our processor charges a fee for card payments. There are a few ways to e-file sales tax returns.

Boulder County does not have a sales tax licensing requirement as our sales tax is collected by the Colorado Department of Revenue. Colorado Taxpayer Services. Debit cards 1 minimum 100.

Through Revenue Online you can also. 400 Duplicate registration. The City may charge sales tax on items on which the State of Colorado does not.

Filing frequency is determined by the amount of sales tax collected monthly. View sales tax rates applicable to your specific business location s. 428 Year and Month Tab Replacement.

DR 0155 - Sales Tax Return for Unpaid Tax from the Sale of a Business. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. If you have more than one business location you must file a separate return in Revenue Online for each location.

Amount of city FOOD SERVICE TAX 015 of line 5B 6. 300 or more per month. For instance the City taxes food for domestic consumption while the State does not.

Get started with a sales tax boulder form 0 complete it in a few clicks and submit it securely. Complete a Business License application or register for a Special Event License. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online.

The Boulder Online Tax System offers enhanced user experiences and tax compliance functionality to city businesses including the ability to. This is the total of state county and city sales tax rates. Effective October 1 2021 the City of Boulder adopted Ordinance No 8457 establishing an economic nexus standard for remote sellers.

DR 0235 - Request for Vending Machine Decals. You can print a 8845 sales tax table here. File online tax returns with electronic payment options.

DR 0100 - 2022 Retail Sales Tax Return Supplemental Instructions DR 0103 - 2022 State Service Fee Worksheet. 820 Duplicate title. For additional e-file options for businesses with more than one location see Using an.

Sales 000 of line 4 000 000 5C. If you pay with an e-check there is no charge to you for the service. If a lien is filed on the title filing fees for the security agreement document will depend on the size and number of pages.

Sales tax rates are also available in the Colorado Sales. View sales tax rates by specific city or county. Businesses with a sales tax liability of up to 15month or 180year.

Monthly returns are due the 20th day of month following reporting period. City of Boulder Sales Tax Form. The County sales tax rate is.

Has impacted many state nexus laws and sales tax collection requirements. Colorado Department of Revenue. The minimum combined 2022 sales tax rate for Boulder Colorado is.

Boulder Countys tax rate is 0985. Return and payment due on or before January 20th each year. The Boulder sales tax rate is.

Sales and Use TaxFinancial Services. Online Sales Tax Filing.

The Freelancer S Tax Guide For 2016 Infographic Tax Guide Income Tax Preparation Business Tax

File Sales Tax Online Department Of Revenue Taxation

Co Dept Of Revenue Co Revenue Twitter

Colorado Just Missed The Top 10 Most Tax Friendly States List Fox31 Denver

File Sales Tax Online Department Of Revenue Taxation

Tax Reform Faqs Top Questions About The New Tax Law Bdo

Sales Tax Filing Information Department Of Revenue Taxation

Consumer Use Tax How To File Online Department Of Revenue Taxation

File Sales Tax Online Department Of Revenue Taxation

Sales And Use Tax City Of Boulder

Online Sales And Use Tax Return Filing And Payment City Of Longmont Colorado